Cash Out Net Worth: The Ultimate Guide To Understanding And Maximizing Your Financial Potential

Let’s dive right into it, folks. When we talk about cash out net worth, we're talking about more than just numbers on a spreadsheet. It's about understanding the true value of what you’ve built and how to unlock it when the time is right. Whether you're a business owner, investor, or just someone looking to make the most out of their assets, knowing your cash out net worth can be a game-changer. So, buckle up because we’re about to break it all down in a way that’s easy to digest but packed with actionable insights.

Now, you might be wondering, "What exactly does cash out net worth mean?" Simply put, it’s the amount of money you could walk away with if you liquidated all your assets today. But here’s the twist—it’s not just about selling everything and pocketing the cash. It’s about strategically converting your wealth into liquid funds without sacrificing long-term growth. And trust me, that’s where the magic happens.

This guide isn’t just about numbers or spreadsheets; it’s about empowering you to take control of your financial future. We’ll cover everything from calculating your net worth to exploring creative ways to cash out without breaking the bank. So, whether you're a seasoned pro or just starting your financial journey, this article’s got you covered.

- Brandi Brandt The Rising Star You Need To Know About

- Barbara Handler The Iconic Figure Who Shaped Modern Real Estate

Let’s get real for a second. Cash out net worth isn’t just a buzzword—it’s a concept that can transform how you view your finances. Think about it: if you knew exactly how much you could cash out tomorrow, wouldn’t that give you peace of mind? Wouldn’t it help you plan better for the future? That’s why we’re here—to demystify the process and show you the ropes.

What is Cash Out Net Worth? Breaking It Down

Alright, let’s get into the nitty-gritty. Cash out net worth refers to the total amount of cash you’d have if you liquidated all your assets. But hold up—it’s not as simple as adding up your bank accounts and calling it a day. Your net worth includes everything from real estate, stocks, investments, and even personal belongings. And yes, we’re talking about your vintage guitar collection too.

Here’s the kicker: cash out net worth isn’t just about what you own—it’s about what you can turn into cold, hard cash. For example, if you own a house worth $500,000, that’s part of your net worth. But if you sell it, you might only walk away with $450,000 after fees and taxes. That’s why understanding the nuances is so important.

- Aylin Mujica The Rise Of A Colombian Powerhouse In Entertainment And Beyond

- Noel Fitzpatrick The Man Behind The Magic Of Saving Lives

Why Cash Out Net Worth Matters

So, why should you care about cash out net worth? Well, it’s like having a financial crystal ball. Knowing your cash out potential gives you clarity on your financial health and helps you make smarter decisions. Whether you’re planning for retirement, buying a new home, or starting a business, understanding your cash out net worth can be a lifesaver.

Think about it this way: if you’re considering a major financial move, wouldn’t it be nice to know exactly how much cash you can access? That’s the power of cash out net worth—it’s not just a number; it’s a roadmap to financial freedom.

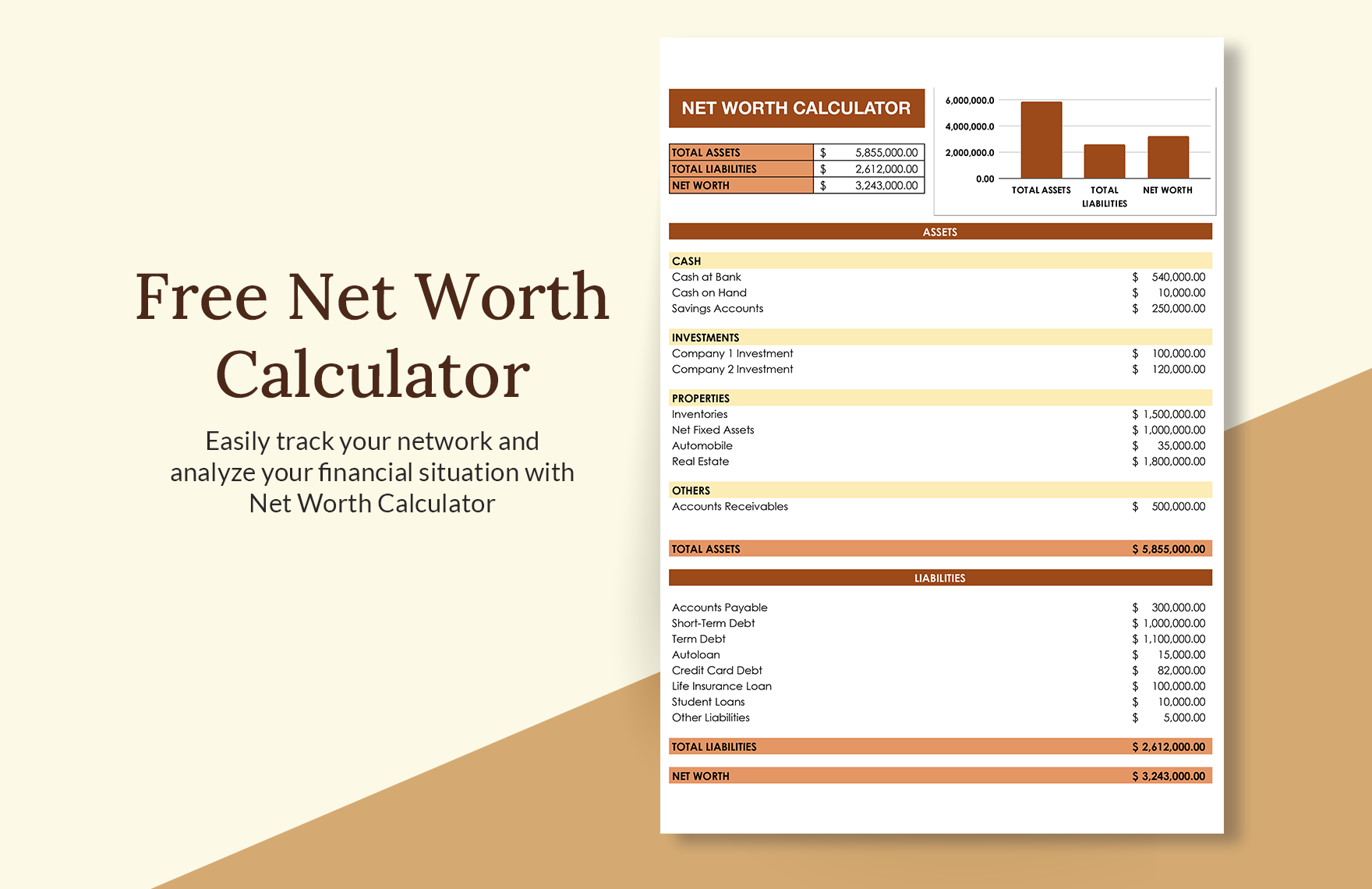

How to Calculate Your Cash Out Net Worth

Now that we’ve got the basics out of the way, let’s talk about the math. Calculating your cash out net worth isn’t rocket science, but it does require a bit of legwork. First, you need to list all your assets—everything from your bank accounts to your car. Then, you subtract your liabilities, like loans and credit card debt. What you’re left with is your net worth.

But here’s the twist: not all assets are created equal. Some are easier to convert into cash than others. For example, selling a stock is a lot quicker than selling a house. That’s why it’s important to factor in liquidity when calculating your cash out net worth.

Steps to Calculate Your Cash Out Net Worth

Ready to crunch the numbers? Here’s a quick guide to help you get started:

- Step 1: List all your assets. This includes everything from cash in the bank to real estate and investments.

- Step 2: Determine the market value of each asset. This might require some research, especially for things like real estate or collectibles.

- Step 3: Subtract your liabilities. This includes any debts or obligations you have, like mortgages or student loans.

- Step 4: Factor in liquidity. Consider how quickly you could convert each asset into cash without losing value.

- Step 5: Add it all up. The final number is your cash out net worth.

Common Misconceptions About Cash Out Net Worth

Let’s clear up some myths, shall we? A lot of people think that cash out net worth is just a fancy way of saying "how much money you have in the bank." But that couldn’t be further from the truth. Your net worth includes all your assets, not just the cash you’re holding. Another common misconception is that cash out net worth is only relevant for the wealthy. Newsflash: everyone can benefit from understanding their financial position.

And here’s another one for you: some folks believe that cash out net worth is a static number. Wrong again! Your net worth can fluctuate based on market conditions, changes in your assets, and even your spending habits. So, it’s important to keep an eye on it and adjust your strategy as needed.

Why These Misconceptions Are Harmful

These misconceptions can lead to poor financial decisions. For example, if you think your net worth is only about cash, you might overlook the value of your other assets. Or worse, you might make impulsive decisions based on incomplete information. That’s why it’s crucial to have a clear understanding of what cash out net worth really means and how it applies to your situation.

Strategies to Increase Your Cash Out Net Worth

Now that you know what cash out net worth is and how to calculate it, let’s talk about how to grow it. There are plenty of strategies you can use to boost your net worth, from investing in real estate to diversifying your portfolio. The key is to find what works best for you and stick with it.

Here are a few ideas to get you started:

- Invest in High-Growth Assets: Consider putting your money into assets that have the potential for significant growth, like stocks or real estate.

- Pay Down Debt: Reducing your liabilities can have a big impact on your net worth. Focus on paying off high-interest debt first.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes to minimize risk.

- Build Passive Income Streams: Creating multiple streams of income can help you grow your net worth over time. Think about rental properties, dividends, or side businesses.

Case Study: How One Person Doubled Their Cash Out Net Worth

Let’s look at a real-life example. Sarah, a small business owner, was able to double her cash out net worth in just three years by implementing a few key strategies. First, she invested in real estate, buying a property that she could rent out for passive income. Next, she paid down her business loans, reducing her liabilities. Finally, she diversified her portfolio by investing in stocks and mutual funds. The result? A cash out net worth that grew from $200,000 to $400,000 in just three years.

Challenges in Cash Out Net Worth

Of course, there are challenges to consider. Market volatility, economic downturns, and unexpected expenses can all impact your cash out net worth. But that’s where planning comes in. By staying informed and adaptable, you can weather the storms and keep growing your wealth.

One common challenge is emotional decision-making. It’s easy to get caught up in the hype of a booming market or panic during a downturn. But the key is to stay disciplined and stick to your long-term strategy. Remember, cash out net worth is a marathon, not a sprint.

How to Overcome These Challenges

Here are a few tips to help you overcome the challenges:

- Stay Informed: Keep up with market trends and economic news so you can make informed decisions.

- Build an Emergency Fund: Having a financial safety net can help you weather unexpected expenses without dipping into your investments.

- Review Your Strategy Regularly: Life changes, and so should your financial plan. Revisit your strategy at least once a year to ensure it’s still aligned with your goals.

Expert Insights on Cash Out Net Worth

We reached out to financial experts to get their take on cash out net worth. One thing they all agreed on? Understanding your net worth is crucial for long-term financial success. "It’s not just about the numbers," said financial advisor John Smith. "It’s about having a clear picture of where you stand financially and using that information to make smart decisions."

Another expert, Sarah Lee, emphasized the importance of liquidity. "While having a high net worth is great, it’s equally important to have access to cash when you need it. That’s why cash out net worth is such a valuable metric."

What the Experts Recommend

Based on their insights, here’s what the experts recommend:

- Focus on Liquidity: Ensure you have access to cash when you need it without sacrificing long-term growth.

- Stay Educated: Continuously educate yourself on financial topics to make informed decisions.

- Plan for the Future: Use your cash out net worth as a tool to plan for retirement, major purchases, and other financial goals.

Final Thoughts: Take Control of Your Financial Future

Alright, let’s wrap this up. Cash out net worth isn’t just a number—it’s a powerful tool that can help you take control of your financial future. By understanding your net worth, calculating it accurately, and implementing smart strategies, you can grow your wealth and achieve your financial goals.

So, what’s next? I encourage you to take action. Start by calculating your cash out net worth today. Then, explore the strategies we’ve discussed and find what works best for you. And don’t forget to review your plan regularly to ensure you’re on track.

One last thing: I’d love to hear from you. What’s your biggest takeaway from this article? Do you have any questions or tips to share? Drop a comment below and let’s keep the conversation going. And if you found this article helpful, be sure to share it with your friends and family. Together, we can all work towards a brighter financial future.

Table of Contents

Article Recommendations

- Tatum Oneal Net Worth The Rise Of A Hollywood Legend And Her Financial Journey

- Orson Welles Net Worth At Death Unveiling The Legacy Of A Cinematic Titan

Detail Author:

- Name : Daisy Yost MD

- Username : gene.heidenreich

- Email : dawson.stoltenberg@heller.org

- Birthdate : 2006-08-06

- Address : 1154 Sammie Underpass West Samirmouth, AR 38311

- Phone : 1-413-912-6098

- Company : Von, Grant and Rempel

- Job : Home Appliance Repairer

- Bio : Recusandae ea commodi at nihil amet nemo voluptatem. Occaecati voluptatum iure voluptas recusandae distinctio aperiam. Eius atque rerum rerum.

Socials

tiktok:

- url : https://tiktok.com/@katrine_xx

- username : katrine_xx

- bio : Deleniti aliquid aliquam veniam cupiditate voluptas eaque. Non rerum vitae quo.

- followers : 2850

- following : 2768

instagram:

- url : https://instagram.com/katrine1421

- username : katrine1421

- bio : Consequatur nobis incidunt nam expedita odio pariatur. Laudantium quasi ea mollitia et.

- followers : 6091

- following : 1206

linkedin:

- url : https://linkedin.com/in/abernathyk

- username : abernathyk

- bio : Dicta exercitationem sit repellat est aut.

- followers : 5005

- following : 796

facebook:

- url : https://facebook.com/katrine_abernathy

- username : katrine_abernathy

- bio : Et et deserunt autem ut et at. Voluptatem fugit ad at adipisci.

- followers : 5442

- following : 257

twitter:

- url : https://twitter.com/katrine_abernathy

- username : katrine_abernathy

- bio : Veniam necessitatibus expedita voluptatum nihil modi voluptatem et. Assumenda ut veniam dolore nihil.

- followers : 2094

- following : 1927