Juul Net Worth: The Complete Guide To The Vaping Empire's Financial Powerhouse

Ever wondered how much Juul is worth? The vaping giant has taken the world by storm, sparking debates, controversies, and financial intrigue. In this article, we’ll deep-dive into Juul’s net worth, uncovering the numbers behind the brand that revolutionized the smoking industry. If you’re curious about how big Juul’s empire really is, you’re in the right place.

Now, let’s get one thing straight—Juul isn’t just another vape company. It’s a tech-driven powerhouse that turned nicotine delivery into a global phenomenon. Founded with a mission to help adult smokers transition away from traditional cigarettes, Juul quickly became a household name. But with great success comes great scrutiny, and Juul’s journey hasn’t been without its share of drama.

In this article, we’ll explore Juul’s net worth, tracing its rise from a startup to a multi-billion-dollar company. From its valuation peaks to the challenges it faced along the way, we’ll break it all down for you. So grab your favorite vape flavor (if you’re into that) and let’s dive into the world of Juul’s financial empire.

- Brooke Dorsay A Rising Star In The Entertainment World

- Joe Theismann Net Worth The Inside Scoop On The Nfl Legendrsquos Wealth

Who Is Juul? A Quick Bio Before the Numbers

Before we dive into the numbers, it’s important to know who Juul really is. Juul Labs, the company behind the popular vaping device, was founded in 2015 by James Monsees and Adam Bowen. These two former smokers turned entrepreneurs had a vision: to create a safer alternative to cigarettes. Fast forward to today, and Juul has become synonymous with modern vaping.

Key Facts About Juul

Here’s a quick rundown of Juul’s background:

- Founders: James Monsees and Adam Bowen

- Year Founded: 2015

- Mission: To provide a satisfying alternative to traditional cigarettes for adult smokers

- Headquarters: San Francisco, California

But let’s not forget, Juul didn’t just pop up out of nowhere. It’s part of the larger PAX Labs family, which has been innovating in the smoking cessation space for years. Now, let’s move on to the juicy part—Juul’s net worth.

- Paul Pelosi Jr The Untold Story You Need To Know

- Jim Cramer Net Worth The Inside Story You Need To Know

Juul Net Worth: Breaking Down the Numbers

As of recent estimates, Juul’s net worth hovers around $3 billion. That’s a far cry from its peak valuation of $38 billion back in 2018 when it secured a massive investment from Altria Group, the parent company of Philip Morris USA. But hey, life’s not all smooth sailing, right? Let’s break down how Juul reached these numbers.

What Contributed to Juul’s Massive Valuation?

A few key factors played a role in Juul’s skyrocketing valuation:

- Innovative Design: Juul’s sleek, USB-like design set it apart from competitors.

- Market Dominance: At its peak, Juul controlled over 70% of the U.S. vaping market.

- Strong Branding: Juul became a cultural phenomenon, thanks to its aggressive marketing and trendy appeal.

But as we all know, every rise has its fall. Let’s explore what happened next.

From $38 Billion to $3 Billion: What Went Wrong?

Remember that $38 billion valuation we mentioned earlier? Yeah, it didn’t last long. A series of controversies, lawsuits, and regulatory crackdowns took a toll on Juul’s finances. Here’s a quick breakdown of what went down:

- Youth Vaping Epidemic: Juul faced backlash for allegedly targeting underage users with its fruity flavors and aggressive marketing.

- FDA Scrutiny: The FDA launched investigations into Juul’s marketing practices and product safety.

- Lawsuits Galore: Juul faced thousands of lawsuits from individuals and states alleging health issues and addiction.

All of this led to a significant drop in Juul’s valuation. But don’t count them out just yet. Juul’s still fighting to reclaim its place in the market.

Juul’s Financial Performance: The Numbers You Need to Know

Let’s talk numbers. Juul’s financial performance has been a rollercoaster ride. Here are some key stats:

- Revenue in 2018: Over $1 billion

- Revenue in 2019: $1.4 billion

- Revenue in 2020: Dropped to $1 billion due to regulatory challenges

Despite the setbacks, Juul continues to generate substantial revenue. The company has also taken steps to rebrand itself as a responsible player in the vaping industry.

How Does Juul Make Money?

Juul’s revenue streams are pretty straightforward:

- Device Sales: Selling its sleek vaping devices.

- Pod Sales: Generating recurring revenue through its nicotine pods.

- Licensing Deals: Partnering with other companies for co-branded products.

But with increasing competition and regulatory hurdles, Juul’s business model is evolving. Let’s see what the future holds.

Investors and Partners: Who’s Behind Juul’s Success?

Juul’s success wouldn’t be possible without its investors and partners. Here are some key players:

- Altria Group: Invested $12.8 billion for a 35% stake in Juul.

- Tiger Global Management: One of Juul’s earliest investors.

- Fidelity Investments: Another major investor in Juul’s early days.

These partnerships have helped Juul scale its operations and weather the storms of controversy. But as we’ve seen, even big investors can’t shield a company from public backlash.

Legal Battles: The Cost of Controversy

Let’s talk about the elephant in the room—Juul’s legal battles. The company has faced thousands of lawsuits, with claims ranging from health issues to misleading marketing. Here’s a snapshot:

- Class-Action Lawsuits: Alleging Juul’s products caused addiction and health problems.

- State Lawsuits: Accusing Juul of targeting minors with its marketing.

- Settlements: Juul has paid millions in settlements to resolve some of these cases.

While these legal challenges have taken a toll on Juul’s finances, the company remains committed to addressing these issues and rebuilding trust.

How Much Have These Lawsuits Cost Juul?

Exact numbers are hard to pin down, but estimates suggest Juul has spent hundreds of millions of dollars on legal fees and settlements. It’s a steep price to pay for a company that once dominated the vaping market.

Regulatory Challenges: Navigating the FDA and Beyond

The FDA has been a major player in Juul’s story. In 2020, the agency issued a marketing denial order (MDO) for Juul’s products, effectively banning them from the market. While Juul successfully appealed the decision, it highlights the regulatory challenges facing the vaping industry.

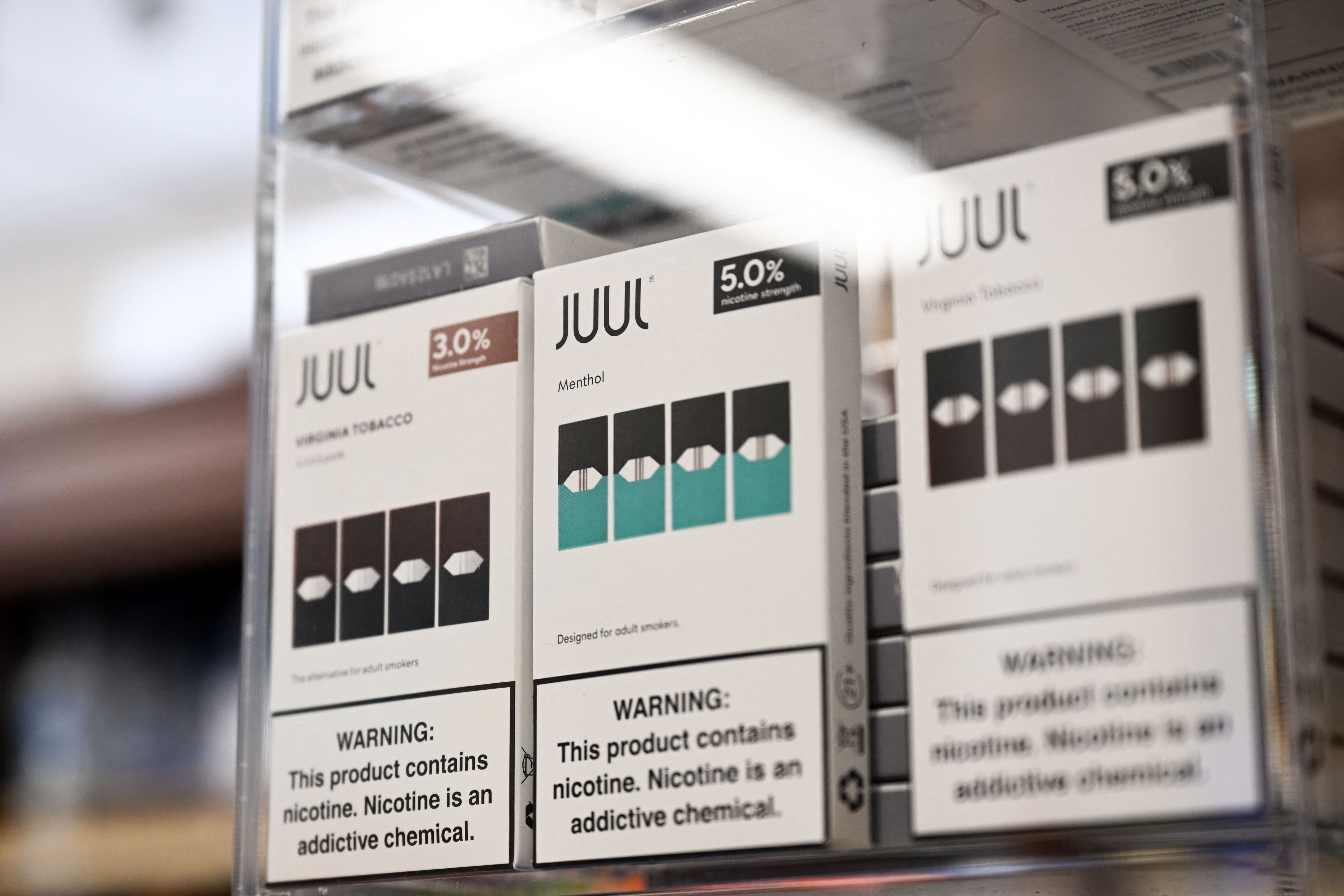

- Product Restrictions: Juul had to remove certain flavors from the market to comply with FDA regulations.

- Advertising Restrictions: Juul faces strict guidelines on how it can market its products.

- Health Warnings: Juul must include prominent health warnings on its packaging and advertising.

Despite these hurdles, Juul continues to innovate and adapt to the changing regulatory landscape.

The Future of Juul: Can They Rebuild Trust?

So, what’s next for Juul? The company is focused on rebuilding trust and repositioning itself as a responsible player in the vaping industry. Here are some of their key initiatives:

- Age Verification: Implementing stricter age verification processes to prevent underage sales.

- Product Safety: Investing in research to improve the safety of their products.

- Corporate Responsibility: Launching campaigns to educate the public about responsible vaping.

While the road ahead won’t be easy, Juul’s leadership remains optimistic about the future.

What Does the Future Hold for Juul’s Net Worth?

It’s hard to predict exactly where Juul’s net worth will go from here. But one thing’s for sure—the company’s future depends on its ability to navigate the challenges ahead. With a focus on innovation and responsibility, Juul may yet reclaim its place as a leader in the vaping industry.

Conclusion: Is Juul Worth the Investment?

So, there you have it—the complete guide to Juul’s net worth. From its meteoric rise to its dramatic fall, Juul’s story is one of innovation, controversy, and resilience. While the company faces significant challenges, it remains a major player in the vaping industry.

If you’re considering investing in Juul or simply curious about its financial standing, keep an eye on how the company navigates the regulatory and legal landscape. And remember, the vaping industry is constantly evolving, so stay tuned for updates.

Got thoughts on Juul’s future? Leave a comment below and let’s chat. Or better yet, share this article with your friends and spread the word about Juul’s journey. Thanks for reading, and we’ll catch you in the next one!

Table of Contents

- Juul Net Worth: The Complete Guide to the Vaping Empire's Financial Powerhouse

- Who Is Juul? A Quick Bio Before the Numbers

- Key Facts About Juul

- Juul Net Worth: Breaking Down the Numbers

- What Contributed to Juul’s Massive Valuation?

- From $38 Billion to $3 Billion: What Went Wrong?

- Juul’s Financial Performance: The Numbers You Need to Know

- How Does Juul Make Money?

- Investors and Partners: Who’s Behind Juul’s Success?

- Legal Battles: The Cost of Controversy

- How Much Have These Lawsuits Cost Juul?

- Regulatory Challenges: Navigating the FDA and Beyond

- The Future of Juul: Can They Rebuild Trust?

- What Does the Future Hold for Juul’s Net Worth?

- Conclusion: Is Juul Worth the Investment?

Article Recommendations

- Byron Allen Net Worth The Untold Story Of Success And Influence

- Brooke Dorsay A Rising Star In The Entertainment World

Detail Author:

- Name : Prof. Joseph Lynch

- Username : candido.ullrich

- Email : arne.kertzmann@quigley.com

- Birthdate : 2003-06-22

- Address : 9957 Walter Valleys Suite 533 New Doylemouth, AL 70226-5740

- Phone : 628.932.9002

- Company : Sauer PLC

- Job : Webmaster

- Bio : Distinctio dolorum blanditiis eius aspernatur dolores. Nesciunt minus aut ipsa voluptatibus dicta ullam optio. Quia nihil sit aut ut ut.

Socials

twitter:

- url : https://twitter.com/heller2021

- username : heller2021

- bio : Sunt itaque qui occaecati sequi. Distinctio facilis eum molestias architecto laboriosam. Tempore et explicabo quidem sed. Eius aut laborum tempore nobis.

- followers : 5964

- following : 1923

linkedin:

- url : https://linkedin.com/in/vernice7848

- username : vernice7848

- bio : Autem sapiente quos iure vel reprehenderit quia.

- followers : 4147

- following : 1500

instagram:

- url : https://instagram.com/hellerv

- username : hellerv

- bio : Eius voluptatum ea aut. Non quia expedita dicta beatae nostrum consequatur accusantium.

- followers : 6427

- following : 394